IRS Guidelines to Determine Worker Classification

The distinction between an employee and an independent contractor is not just a matter of titles—it has significant implications for tax responsibilities, benefits, and the level of control an organization has over a worker. The IRS Publication 1779 is a key resource employers should be aware of when determining whether a worker is an employee or an independent contractor.

Why Does Accurate Classification Matter?

The consequences of misclassification can be severe for nonprofits; misclassifying an employee as an independent contractor can lead to penalties, including back taxes and fines. Moreover, it affects the worker’s eligibility for benefits and protections, such as workers’ compensation and unemployment insurance.

Ultimately, the determination of whether a worker is an employee or an independent contractor should be based on IRS guidelines, rather than the personal preference of the worker or what is most advantageous for the employer. We want to help you make sure you do everything in your power to avoid these unnecessary penalties! Below are three categories the IRS highlights that can help you determine an employee vs. an independent contractor.

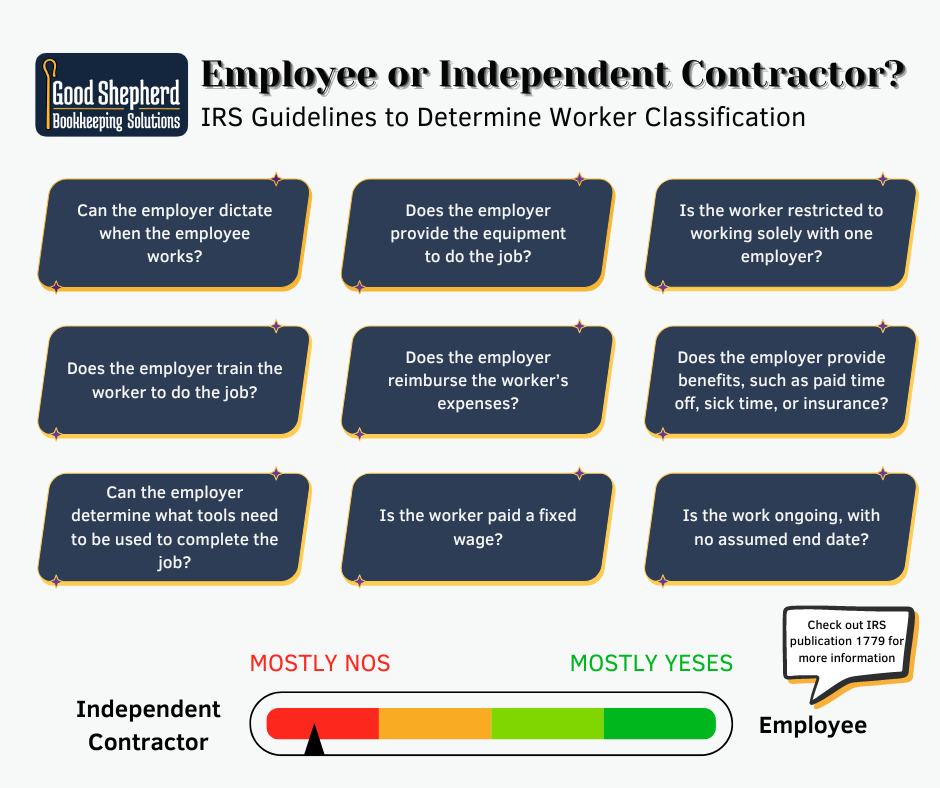

1) Behavioral Control

The primary factor distinguishing an employee from an independent contractor is the degree of control an employer has over the work being performed. If the employer has the right to control and direct the worker (even if this right isn’t being utilized), this suggests the worker is an employee.

For example, if the employer can dictate 1) what hours an employee works, 2) how the work should be done, and 3) what tools or equipment the worker should use to complete the job, that individual is likely an employee.

Training provided by the business on specific procedures is also an indicator that the worker may be an employee since the employer is outlining how they want the work to be completed. In contrast, an independent contractor will receive broad instructions on what work should be done, but not necessarily how or when the work should be completed.

A common situation in churches:

In the case of a part-time employee such as a worship director, do you tell them when they need to show up for services? Do you suggest music to play (and music that can’t be played)? Are they expected to be there every Sunday, as well as certain nights for rehearsal? If yes to any of the questions above, they’re likely an employee.

2. Financial Control

Financial control examines the degree to which the job impacts the worker’s finances. Employees usually receive a steady wage and may have their business expenses reimbursed. Independent contractors, however, typically make significant investments in their tools, equipment, or workspace; these expenses typically aren’t reimbursed by the employer. This investment could include purchases like a high-grade computer, specialized machinery for specific jobs, or even a dedicated workspace or office.

In contrast, employees are generally provided with all the necessary tools and resources to perform their job by the employer without significant personal investment. Additionally, independent contractors may have the freedom to work with multiple clients simultaneously and decide how much to charge for their services, further emphasizing their financial independence.

3. Relationship of the Employer and Worker

The permanency of the relationship and the benefits offered are also telling factors. Employees often have a more permanent relationship with an organization, possibly with benefits like insurance, pension plans, sick time, and vacation pay. Independent contractors may have a temporary relationship focused on a specific project, though that’s not always the case.

The IRS bases a worker’s status on the actual execution of the relationship, rather than the terms stated in the employment contract.

It’s important to note that all the factors should be taken into account before making a decision; the IRS asserts that no single fact or instance should determine worker classification.

Steps to Ensure Compliance with these Regulations

- Review IRS Guidelines: Familiarize yourself with IRS Publication 1779 and other relevant resources provided by the IRS to understand the nuances of worker classification.

- Evaluate Current Workers: Assess each work relationship using the behavioral control, financial control, and relationship nature criteria to determine the appropriate classification.

- Document Each Decision: Keep detailed records of the factors that influenced your classification decision for each worker. This documentation can be vital in the case of an audit.

- Seek Professional Advice: When in doubt, consult with a tax professional or attorney who specializes in employment law to ensure that your organization’s worker classification practices comply with current laws.

Accurately classifying workers as employees or independent contractors is essential for maintaining compliance with tax laws and avoiding costly penalties. By applying the principles outlined in IRS Publication 1779, you can protect your organization in the case of future audits.